It took me a long, long time to gain enough confidence to start charging clients a significant amount of money. It was until I moved to Virginia last June that I felt like I really learned the value of what I do and how much people actually appreciate it. There are so many things I feel like I don’t know when it comes to running a photography business, but I do feel like in the past couple of months I have gotten a handle on what it takes to follow the law and make sure my business is legit.

In the great state of Texas and many other places, you have to charge a sales tax for your services. I’m a shoot and share photographer, which means I don’t charge a sitting fee and then have people purchase print packages. I shoot the session and deliver all the usable images to the client for one flat fee. The sales tax rule is different for those who charge sitting fees and then charge for prints, which I’m not going to get into since I have no personal experience with that. Since I only charge one flat fee, I have to tax the whole session since my clients will be receiving the images (considered tangible items) from me. Texas requires a sales tax of 8.25% (including state & local tax) to be charged.

I recently had someone ask, “How do you do your taxes on any income you bring in on photography?”

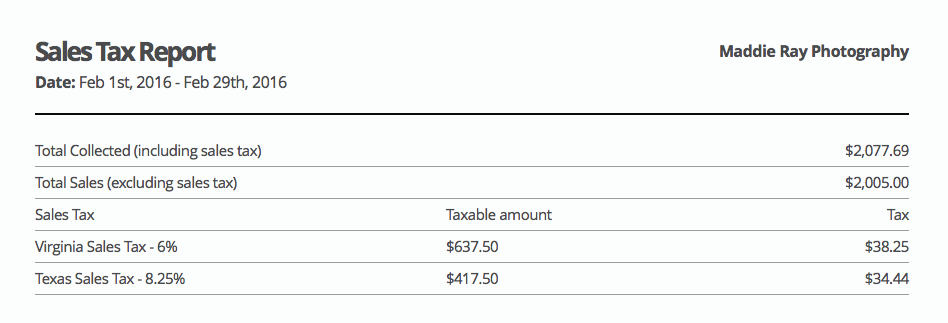

Here is my handy dandy secret… 17hats. I will blog more about the greatness of 17hats later, but if you’re interested in checking it out now here is a referral code to use: https://17hats.com?r=xgrbrnnrkt. So how does 17hats help me do taxes? Well, I send my invoices through my 17hats account that allows my clients to pay directly through PayPal. 17hats has a bookkeeping feature that tracks the sales tax charged for each session or wedding. I can pull up a Sales Tax Report via the bookkeeping tab and it will tell me how much money I owe the state of Texas for the current month or during what time period I choose. By the way, Sales + Use Tax is due around the 20th of each month. You HAVE to file whether or not you made any money if you don’t want to be charged with a hefty $50 late fee. You can file online via WebFIle on the Texas Comptroller’s website. It’s pretty easy!

If you’re not ready to invest in a program like 17hats, then I suggest checking out this blog post for examples on how to manage taxes + business expenses: http://rebekahhoytblog.com/fotog-friday-managing-money/.

Another suggestion I have is to open a separate business account or even a credit card that you pay off monthly. It is important you see what your cash flow is when running a business and you need it to flow without personal purchases breaking it up. This will only help with taxes in the long run + I’m pretty sure the IRS prefers it. Their your bosses in reality. Don’t make them mad! 😉

Now, did you know you have consider income tax + self-employment tax depending on your business structure? I know… it sucks. When it comes to taxes, I like to save EVERY retainer fee paid by my clients. This means I’m saving 50% of the session fee, which will definitely cover my income tax, sales tax, and help me save money in the long run. This is why you should really be pricing your sessions according to what taxes + business expenses you need to cover. More about pricing in a later blog. It needs it’s own novel.

So how do I save money for taxes?

I have a USAA savings account + a business PayPal account with the debit card for business purchases. I haven’t ventured towards a business credit card yet, but I know a lot of photographers have one. I transfer each retainer fee over to my savings when it is paid and then I feel so much better. 🙂

Here is another great blog post for running a legit photography business: http://rebekahhoytblog.com/fotog-friday-taking-care-of-business/.

Also, here is the Photographers + Texas Sales Tax bulletin directly from the Texas Comptroller. READ THIS! http://comptroller.texas.gov/taxinfo/taxpubs/tx94_176.pdf

I have re-read these post multiples time and they have helped me out a ton! I hope my advice has helped you in some way. I do not claim to be an expert on taxes and probably never will be. These are just the steps I’ve taken to conquer taxes. It is indeed still a work in progress! 😉

Here’s how I feel when my taxes are all taken care of…

HAPPY FRIDAY!! xoxo